Triple H gets a new WWE job title and changes made to the base salaries of top officials

WWE provided the following information in a filing with the Securities and Exchange Commission…

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

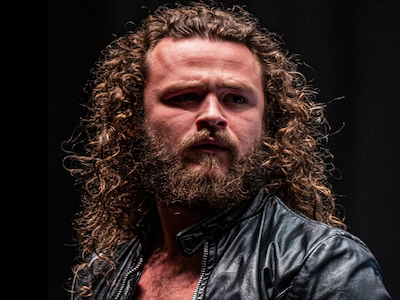

As previously disclosed, Vincent K. McMahon resigned from all positions held with the Company on July 22, 2022 (the “Effective Date”). Mr. McMahon remains a stockholder with a controlling interest. His roles as an executive officer since that date have been assumed among four individuals, each of whom was already an executive officer of the Company: Stephanie McMahon-Levesque, Chairwoman and Co-CEO; Nick Khan, Co-CEO; Frank A. Riddick, III, Chief Financial Officer and Chief Administrative Officer; and Paul Levesque, Chief Content Officer.

Effective September 2, 2022, Mr. Riddick was promoted to President; he will continue in his role as Chief Financial Officer.

Due to these changes, the Company’s Compensation and Human Capital Committee determined on August 31, 2022 that it is appropriate to provide certain enhancements to the compensation of Ms. McMahon and Messrs. Khan, Riddick and Levesque as described below:

1. Changes in Base Salary.

As of the Effective Date, (i) Ms. McMahon’s annual base salary increased from $730,000 to $1.35 million. Ms. McMahon will continue to receive payments including, without limitation, the $750,000 guaranteed minimum under her booking agreement, as amended, which is listed as an exhibit (and incorporated by reference) to our Annual Report on Form 10-K/A filed with the SEC on August 16, 2022; (ii) Mr. Khan’s annual base salary increased from $1.2 million to $1.35 million; (iii) Mr. Riddick’s annual base salary increased from $850,000 to $950,000; and (iv) Mr. Levesque’s annual base salary increased from $730,000 to $900,000. Mr. Levesque will continue to receive payments including, without limitation, the $1.0 million guaranteed minimum under his booking agreement, as amended, which is listed as an exhibit and incorporated by reference) to our Annual Report on Form 10-K/A filed with the SEC on August 16, 2022.

2. Changes in Annual Target Bonus Opportunity under the Company’s 2016 Omnibus Incentive Plan.

The following annual target bonus opportunities (as a percentage of annual base salary) were established. As disclosed from time to time in our annual proxy statements, these are target opportunities only and actual bonuses paid may be above or below these amounts based on, among other factors, the Company’s performance vis-à-vis performance metrics established by the Compensation and Human Capital Committee: (i) Ms. McMahon: 160%; (ii) Mr. Khan: 160%; (iii) Mr. Riddick: 125%; and (iv) Mr. Levesque: 100%. In respect of annual bonuses to be paid for 2022 to each of Ms. McMahon, Mr. Khan, Mr. Riddick and Mr. Levesque, the percentage changes will be prorated from the Effective Date.

3. Future Annual Equity Grants under the Company’s 2016 Omnibus Incentive Plan.

While grants of equity remain at all times within the discretion of the Company’s Compensation and Human Capital Committee, it is expected that annual grants beginning in 2023 shall have the following grant date target values, subject to performance metrics and vesting periods. The Company’s current practice is to value grants at an average of the closing price of the Company’s Class A Common Stock on the New York Stock Exchange over the thirty trading days immediately preceding the grant date: (i) Ms. McMahon: $3.575 million; (ii) Mr. Khan: $3.575 million; (iii) Mr. Riddick: $2.4 million; and (iv) Mr. Levesque: $1.6 million.

4. Special Equity Grants

In addition to the foregoing, Ms. McMahon will receive a one-time special equity grant of performance stock units (“PSUs”) with a grant date target value (valued as described in Section 3 above) of $10 million on or about October 3, 2022. This grant will have a three-year performance measurement period ending September 30, 2025, at which time the PSUs, adjusted as a result of performance, would vest. 82.5% of the performance metrics for Ms. McMahon will be based on certain media rights agreements and consolidated revenue, and the remainder will be based on the Company attaining certain human capital and governance goals to be determined by the Compensation and Human Capital Committee. Similarly, Mr. Levesque will receive a one-time special equity grant of PSUs with a grant date target value of $8 million on or about October 3, 2022. This grant will also have a three-year performance measurement period ending September 30, 2025, at which time the PSUs, adjusted as a result of performance, would vest. 65.0% of the performance metrics for Mr. Levesque will be based on certain media rights agreements, and the remainder will be based on the attainment of certain milestones relating to talent development and creative matters to be determined by the Compensation and Human Capital Committee.

5. Severance Protection in the event of a Change in Control.

In order to achieve enhanced parity among senior executives and provide incentive to them to remain in their positions in the event that a Change in Control (as defined below) of the Company (no such change is currently contemplated) together with a Second Trigger (as defined below) the agreements between the Company and each of Ms. McMahon, and Messrs. Khan, Riddick and Levesque will be established (in the case of Ms. McMahon and Mr. Levesque) or amended (in the case of Messrs. Khan and Riddick) to include the following change in control severance terms:

(i) “Change in Control” will be defined as follows:

A “Change in Control” shall mean the occurrence of any of the following; provided, however, that “Change in Control” shall have any “Change in Control” or similar definition contained in Section 409A of the Internal Revenue Code in any instance in which amounts are paid under a compensation agreement as a result of a Change in Control and such amounts are treated as deferred compensation under Section 409A:

(a) The acquisition in one or more transactions, other than from the Company, by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act), other than the Company, a Company subsidiary or any employee benefit plan (or related trust) sponsored or maintained by the Company or a Company subsidiary, of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Securities and Exchange Act of 1934 as amended) of a number of Company securities aggregating 30% or more of the vote of all voting securities;

(b) Any change in the composition of the Board of Directors within a 24-month period that results in more than fifty percent (50%) of the independent members of the Board of Directors consisting of persons other than (i) those persons who were independent members of the Board of Directors at the beginning of such 24-month period and/or (ii) persons who were nominated for election as independent members of the Board of Directors at a time when more than fifty percent (50%) of the Board of Directors consisted of persons who were independent members of the Board of Directors at the beginning of such 24-month period; provided, however, that any person nominated for election by the Board of Directors, more than fifty percent (50%) of whom consisted of persons described in clause (i) and/or (ii), shall, for this purpose, be deemed to have been nominated by a Board of Directors composed of persons described in clause (i);

(c) The consummation (i.e., closing) of a reorganization, merger or consolidation involving the Company, unless, following such reorganization, merger or consolidation, all or substantially all of the individuals and entities who were the beneficial owners of the Company’s common stock immediately prior to such reorganization, merger or consolidation, following such reorganization, merger or consolidation beneficially own, directly or indirectly, more than 70% of both the then outstanding shares of common stock and the combined voting power of the then outstanding voting securities of the entity resulting from such reorganization, merger or consolidation in substantially the same proportion as their ownership of the Company’s common stock and outstanding voting securities immediately prior to such reorganization, merger or consolidation;

(d) The consummation (i.e., closing) of a sale or other disposition of all or substantially all the assets of the Company, unless, following such sale or disposition, all or substantially all of the individuals and entities who were the beneficial owners of the Company’s common stock immediately prior to such sale, beneficially own, directly or indirectly, more than 60% of both the then outstanding shares of common stock and the combined voting power of the then outstanding voting securities of the entity purchasing such assets in substantially the same proportion as their ownership of the Company’s common stock and outstanding voting securities immediately prior to such sale or disposition;

(e) the consummation of any transaction described in in (a) or (c) above, following which Vincent K. McMahon and his family (as defined in Section 267(c)(4) of the Internal Revenue Code) retain beneficial ownership of voting securities of, as applicable, the Company, its successor or the ultimate parent corporation or other entity of the chain of corporations or other entities which includes the Company or its successor, representing voting power that is less than that of any other individual, entity or group; or

(f) A complete liquidation or dissolution of the Company.

(ii) There will be a consistent “Second Trigger” across all executive officers’ agreements which will include a termination of his or her employment by the Company without cause or a resignation by the executive officer for Good Reason (as defined below) on the date of or within the two (2) year period following a Change in Control.

“Good Reason” will be defined to include any of the following:

(a) a reduction in Base Salary and/or target compensation for the executive;

(b) a material change of title, authority, duties or responsibilities including, without limitation (i) in the case of either Ms. McMahon or Mr. Khan, ceasing to have the title and duties of chief executive officer or co-chief executive officer of the Company, (ii) in the case of Ms. McMahon, being the co-chief executive officer with anyone other than Mr. Khan, (iii) in the case of Mr. Khan, being the co-chief executive officer with anyone other than Ms. McMahon;

(c) an adverse change in the reporting structure applicable to the executive, which (i) in the case of either Ms. McMahon or Mr. Khan shall mean such executive is required to report to any person(s) other than the full Board of Directors and (ii) in the case of either Mr. Riddick or Mr. Levesque shall mean such executive is required to report to any person other than Ms. McMahon and/or Mr. Khan;

(d) a material breach by the Company or the successor of the terms and conditions of any employment or other compensation agreement with the executive;

(e) the failure to obtain an agreement from any successor to assume and agree to perform all equity and other compensatory agreements in the same manner and to the same extent as would be the case if no change had occurred (unless such assumption occurs by operation of law); or

(f) except with respect to Mr. Riddick, the Company’s failure to nominate the executive for election to the Board of Directors and to use its best efforts to have the executive elected to the Board of Directors.

Notwithstanding the foregoing, in the event the executive asserts that one of the foregoing reasons exists for potential termination of employment, the executive shall first provide the Company written notice specifying the nature of the reason and the Company will have at least thirty (30) days to cure or remedy the situation. If the executive has not terminated employment within ninety (90) days after the occurrence of such Good Reason situation or event that has not been cured or remedied by the Company, the executive will be deemed to have waived the right to terminate on the basis of Good Reason with respect to the situation or event giving rise to Good Reason.

(iii) In the event of a Change in Control and the occurrence of a Second Trigger event (an “Eligibility Event”), the executive officers will be entitled to the following payments and benefits:

(a) Ms. McMahon: (1) two times her then-current base salary; (2) two times the target bonus opportunity for the year in which the Eligibility Event occurs; (3) an annual bonus based on actual performance for the year of the Eligibility Event and prorated for the portion of the calendar year that has lapsed prior to the Eligibility Event; (4) full vesting of all equity grants outstanding at such time, including, without limitation, the special grant described above, and with performance awards vesting (x) at target level of achievement for awards for which performance is incomplete as of the date of the Eligibility Event and (y) based on actual performance for awards for which performance has been completed as of the date of the Eligibility Event; and (5) continued health benefits for twenty-four months.

(b) Mr. Khan: (1) two times his then-current annual base salary; (2) two times the target bonus opportunity for the year in which the Eligibility Event occurs; (3) an annual bonus based on actual performance for the year of the Eligibility Event and prorated for the portion of the calendar year that has lapsed prior to the Eligibility Event; (4) full vesting of all equity grants outstanding at such time, including, without limitation, all special grants previously made to Mr. Khan, and with performance awards vesting (x) at target level of achievement for awards for which performance is incomplete as of the date of the Eligibility Event and (y) based on actual performance for awards for which performance has been completed as of the date of the Eligibility Event; and (5) continued health benefits for twenty-four months.

(c) Mr. Riddick: (1) one and a half times his then-current annual base salary; (2) one and a half times the target bonus opportunity for the year in which the Eligibility Event occurs; (3) an annual bonus based on actual performance for the year of the Eligibility Event and prorated for the portion of the calendar year that has lapsed prior to the Eligibility Event; (4) full vesting of all equity grants outstanding at such time, including, without limitation, all special grants previously made to Mr. Riddick, and with performance awards vesting (x) at target level of achievement for awards for which performance is incomplete as of the date of the Eligibility Event and (y) based on actual performance for awards for which performance has been completed as of the date of the Eligibility Event; and (5) continued health benefits for eighteen months.

(d) Mr. Levesque: (1) one and a half times his then-current annual salary; (2) one and a half times the target bonus opportunity for the year in which the Eligibility Event occurs; (3) an annual bonus based on actual performance for the year of the Eligibility Event and prorated for the portion of the calendar year that has lapsed prior to the Eligibility Event; (4) full vesting of all equity grants outstanding at such time, including without limitation, the special grant described above, and with performance awards vesting (x) at target level of achievement for awards for which performance is incomplete as of the date of the Eligibility Event and (y) based on actual performance for awards for which performance has been completed as of the date of the Eligibility Event; and (5) continued health benefits for eighteen months.

These enhancements are in addition to, and not in lieu of, benefits currently included in agreements with the executive officers. In certain instances, the enhancements described above are already in agreements with Messrs. Khan and Riddick, and in those instances, there will not be a duplication of benefits.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the agreements contemplated to be entered into, which will be filed as exhibits to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2022 and is incorporated by reference herein.